Ocean Front Condo on

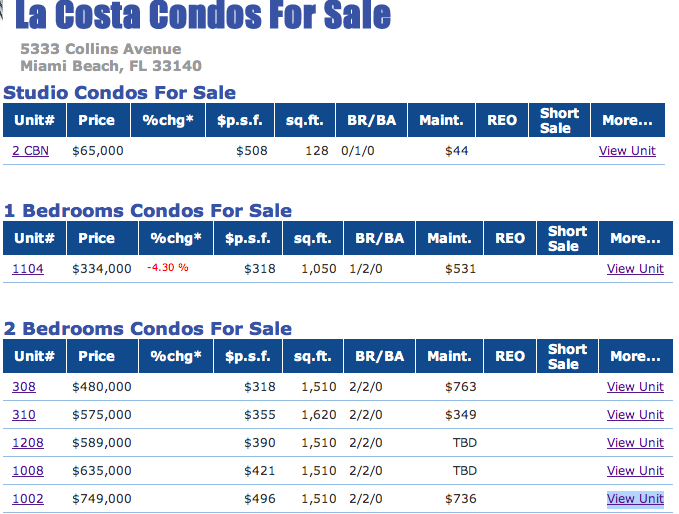

Property Fair Market Value +$280,000 - $480,000!

Now is YOUR chance to obtain valuable Real Estate...for just pennies on the dollar!

Seller can gladly offer foreclosure and transfer assistance if needed.

Spacious and Bright 2 bedrooms, 2 bathrooms.

Fantastic views from this property!

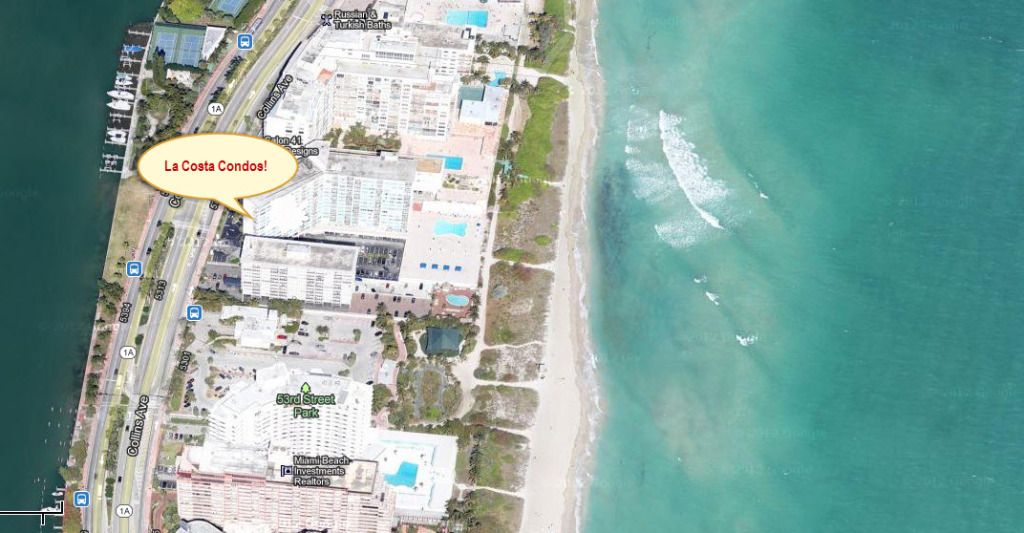

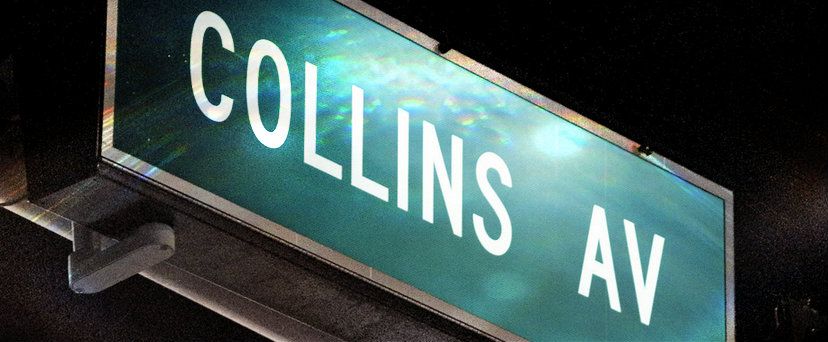

The La Costa condominium is LOCATED on the Atlantic Ocean in the Millionaires Row area of Miami Beach.

Just steps from the beach and a few minutes drive to world famous South Beach!!

Property Fair Market Value + $280,000 - $480,000!

Please use your browser's zoom feature to see more details in the pictures.

Local Condo Sales Website:

This is an auction on this Real Estate Tax Lien Certificate ONLY, with a face value of $42.72 on:

Ocean front condo building, located at 5333 Collins Ave. Unit 107, Miami, Florida.

Mint 2 bedroom 2 bathroom, 1,180 Sq. feet of oceanfront condo living. This building has a gorgeous pool!

ADDITIONAL INFORMATION

Frequently asked Questions:

Q. Is it possible that the winner of this Tax Certificate may follow Miami-Dade County Florida procedures and apply for a Tax Deed in June of 2014; And have the opportunity to win this valuable real estate free and clear, for pennies on the dollar?

A. Yes! In fact, on December 17, 2008, a friend of ours, Bill, attended a live tax lien auction and purchased 110 properties for a total of $45,272. Here, 110 properties for only $45,272 equates to only $411 each. Within 45-days for this tax lien deed auction, Bill received Deed Ownership to all 110 properties, FREE & CLEAR, with NO mortgage or mechanic liens against the properties. Consequently, when you receive Deed Ownership on a tax lien property, the Deed/Title is washed clean from all mortgage and mechanic liens.

Q. Where do Tax Lien Certificates Come From?

A. Issued by federal, state, or local tax authorities, a tax lien is placed against the title/deed of real estate when the owner fails to pay taxes. The tax lien prevents the owner from selling the property until the debt is paid. Here's where the tax lien investor comes in. By purchasing the tax lien certificate held against the real estate, you're (the investor) entitled to repayment of the face value of the tax lien certificate, plus considerable interest. In the event the real estate owner fails to repay you accordingly, you (the investor) can move the county for a tax deed sale after two-years from the original date the tax lien certificate was sold to the investor by the taxing authority. Here, the dead line for the property owner to redeem this specific real estate expires in June of 2014. A Tax Lien Certificate is a first lien on the real estate. Purchase of a tax certificate does not permit the certificate holder to enter the property or contact the owner. A tax deed sale and/or redemption is done through the County office only.

Terms and Conditions:

Disclosure

1. Investment opportunity: You are bidding on a real estate tax lien certificate on real estate with an assessed value of up to $500,000. The Investor/Bidder is bidding on a 2012 Real Estate Tax Lien Certificate from Miami-Dade County, FL. The Winner may have the opportunity to move for a foreclosure Deed on said property on or after June 2014 (See Paragraph 3 below).

2. Liens: The amount of back taxes owed on this property is $42.72; which is the face value of the tax lien certificate for this property.

3. Benefits: The original owner of this property has 24 months to redeem this investment. In order to redeem this investment, the original owner must pay the tax lien certificate holder the face value of the tax certificate. In the event this tax cert is redeemed, the buyer will receive the refund for the face value of the cert from the County.

4. Earned Interest: In addition to paragraph 3, if redeemed, upon your notice to the seller, the certificate holder will receive 18% interest on the face value of the tax lien cert from the Seller.

5. Tax Deed Application: If the property owner fails to redeem this property on or before June, 2014, you can then seek a tax deed application via the county.

6. Customer Service: Seller will provide buyer with step-by-step instructions addressing tax lien certificates and how to pursue a tax deed application.

7. PAYMENT/TRANSFER FEE: The Transfer Fee of $195.00 will be added to the Winning Bid. Payment is due within 3 - days from the conclusion of this auction/sale. Once Buyer's total winning bid amount has been received by Seller, Buyer will receive a copy of the tax lien certificate transfer documents, with easy to follow instructions, via certified return receipt, Priority Mail. Seller will complete transfer documents and assist Buyer with this easy transfer. Payment is to be made by Buyer to Seller via a Bank Wire! Otherwise, if Buyers chooses to pay via cashier’s check, then Buyer shall supply Seller with proof of service, via certified mail.